COVID-19 Dx: Both Cases and Testing Continue to Moderate… What’s Next?

February 17, 2021

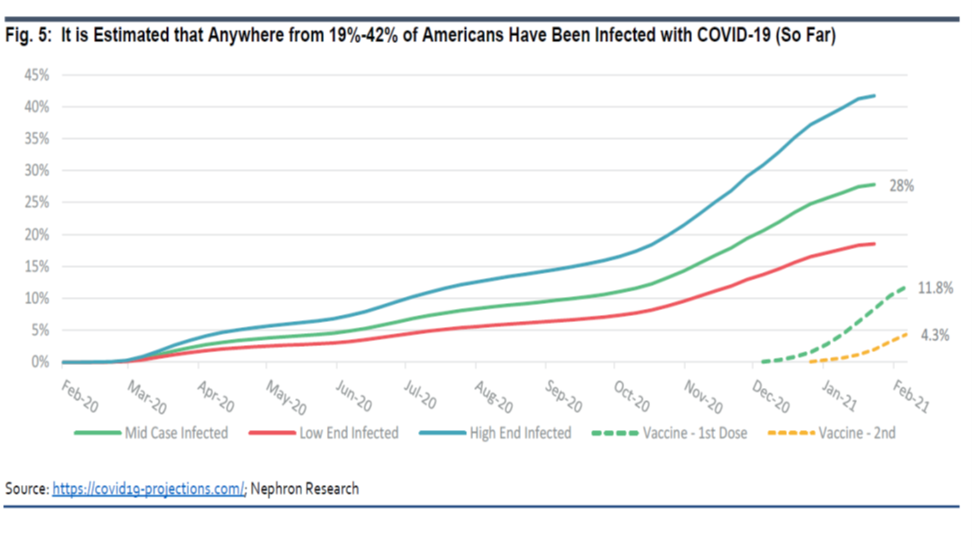

Nephron’s Jack Meehan was in print earlier this week as the respiratory season draws to a close and encouraging signs have emerged in the recent COVID-19 case data. The hope, obviously, is that the commercialization of COVID-19 vaccines is beginning to have an impact. Between that and the fact that a meaningful number of Americans have been infected with COVID-19 at this point, Jack took a look at what this means for the testing market looking forward. A few takeaways from the report:

- Tests peaked at 14mm the week of 1/11 (source: COVID Tracking Project), and moderated to 11.2mm the week of 2/8. LabCorp and Quest’s share has also taken a step down over the last two weeks into the low-teens (from 20%ish in January). We always assumed share would drift lower, and think LabCorp and Quest are actually doing pretty well at supporting testing needs with their PSCs and health system relationships. Variants remain a wildcard, of course.

- National Lab Updates: As of 2/16, Quest is reporting a cumulative 34.2mm COVID-19 detection tests run. This is up from the company’s prior disclosure on 2/2 of 32.9mm tests run – implying a two week contribution of 1.3mm tests (or 650K per week on average). Quest’s capacity is now at 230K per day (up from 225K). At 93K tests per day in the last two weeks, Quest is running at 40% of its maximum daily capacity. As a reminder, for 4Q20, Quest ran 12.2mm detection tests –up from 10mm tests in 3Q20.

- National Lab Updates on COVID-19 Serology Testing: Serology demand remains weak overall. Quest is reporting a cumulative 5.2mm COVID-19 serology tests run as of 2/16. This represents a weekly rate of 50K tests, and <5% of Quest’s stated capacity of 200K tests per day.

Email info@nephronresearch.com for more information on this report and Nephron Research.