High COVID-19 Productivity – Producing Our Way Through Quarantine

March 27, 2020

First of all, we hope this post finds you and those close to you in good health. As an NYC-based firm, we’d be remiss not to acknowledge the dedication and selfless bravery of our first responders and healthcare providers. We are supremely grateful. Over the last couple weeks we resolved to stay put, wash our hands, and (try to) not touch our faces. But we were also inspired to “do our part” in our own little way. That way has always been to make ourselves essential to our clients’ investment process, and right now that means navigating a sea of information and statistics (some good, some not-so-good) and assemble a mosaic to explain the impacts of COVID-19 on our covered companies and the healthcare system in the US as a whole. Since March 12th, we’ve put out over TWENTY individual pieces of research including a daily “COVID-19 tracker” which has expanded at this point to well over 30 pages including:

- Headlines and Updates

- Historical Perspective

- COVID-19 Global Tracker

- Virus Progression in NY and WA vs. Rest of World

- US/State Commentary

- Analysis of Testing Expansion

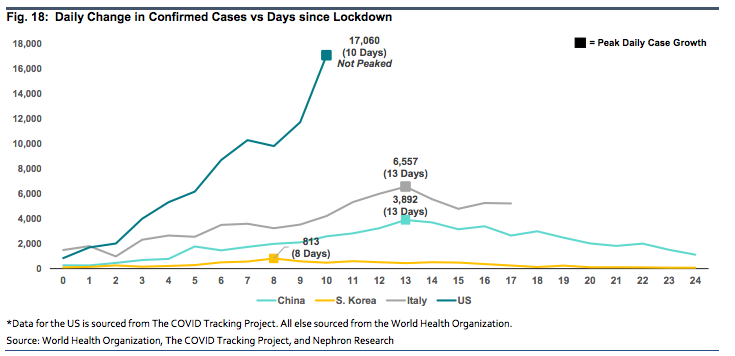

- *NEW THURSDAY* – Tracking Changes in Daily Case/Death Growth after Lockdown

- *NEW FRIDAY* – New analysis of post ‘lockdown’ disease progression

We’ve stayed nimble and evolved the format with changes in information and the needs of our subscribers.

As self-acknowledged data nerds, we’ve picked out a few highlights from other COVID-related notes that we hope are useful to the healthcare community

3/13/20: Interest Rate Impacts on Health Insurers

At their core, the managed care organizations are insurance companies, with significant exposure to fixed income investments. Overall, we see a very short-term benefit (lower yields create larger unrealized gains – which can be realized) that is then met with a longer-term risk (around reinvestment and then investment income levels).

3/23/20: Data Points from the Covered California Estimates of COVID Commercial Costs

The group that is responsible for running the California health insurance exchanges (Covered California) published at lobby piece in the form of a public analysis that sought to estimate the total cost of COVID-19 to the commercial employer market. Including both risk based insurance buyers and self insured employers, the analysis estimated that the total cost would be between $34-$251 billion in one year.

3/15/20: Healthcare Private Sector Expands COVID-19 Response

Re: Trump administration “‘unleashing the power of the private sector, focusing on providing convenient tests to hundreds of thousands of Americans” – While the impact on healthcare share performance was immediate, we believe the economic opportunity for pharma and the supply chain is less important than the opportunity to demonstrate the ways in which they contribute positively to society. Analyses include:

- Walgreens and CVS will play a key role in expediting testing.

- The financial impact of an eventual vaccine could be material for McKesson.

- Elevated distributor and pharmacy volumes are likely to slow.

As always, we’re eager to be in touch and help where we can. For more information, please email info@nephronresearch.com