How Amazon Pharmacy Launch May Disrupt Pharmacies, PBMs, Distis and GoodRx

November 17, 2020

Earlier today, Nephron Research analyst Eric Percher published a report digging into the launch of two new pharmacy offerings from Amazon and followed up with group conference call and Q&A for clients.

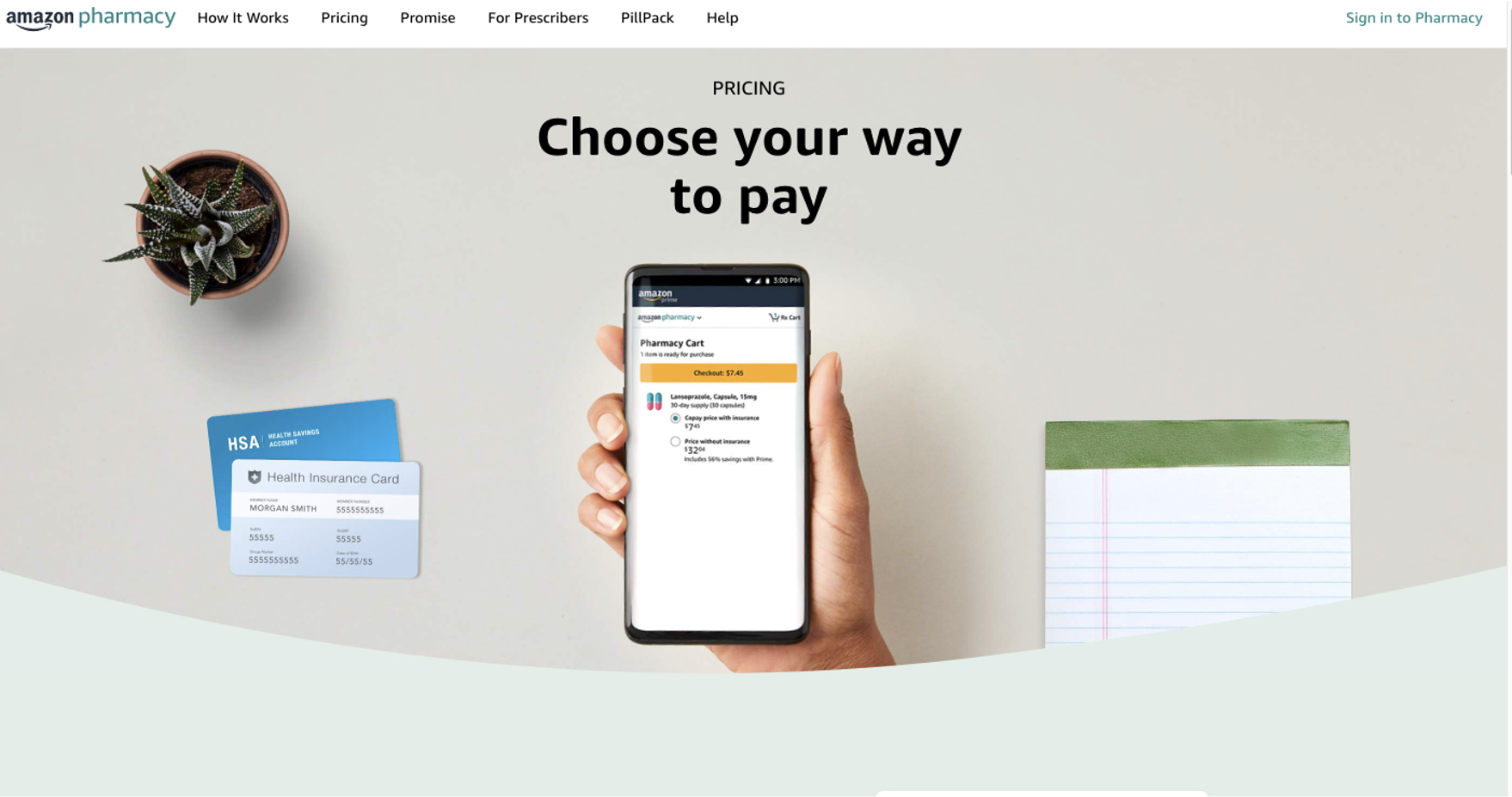

Each of the new offerings holds unique implications for the pharmaceutical supply chain. The offerings include the launch of an Amazon Pharmacy store distinct from PillPack, which will seek to improve on the current mail experience, potentially accruing share from mail and retail pharmacies and the Amazon Prime Prescription Savings Benefit (enabled by Cigna/Evernorth subsidiary InsideRx) that can be utilized via Amazon Pharmacy and at 50K pharmacies participating in the InsideRx program.

Our views on Amazon’s ability to disrupt the pharmacy marketplace always come back to three core competencies/advantages that Amazon has enjoyed in other markets: 1) the ability to improve the consumer experience, 2) the ability to offer a broad selection and 3) the ability to catalyze price competition. Percher’s analysis for clients was framed within this construct.

On the follow up conference call for clients, Percher reviewed Amazon’s positioning and dug further into the interdependencies and implications for the broad supply chain including Digital Pharmacies, Retail Pharmacies, PBMs, Health plans and GoodRx. info@nephronresearch.com for more info.