Last Week’s CAH Upgrade More About Earnings Power Than Catalysts

March 30, 2021

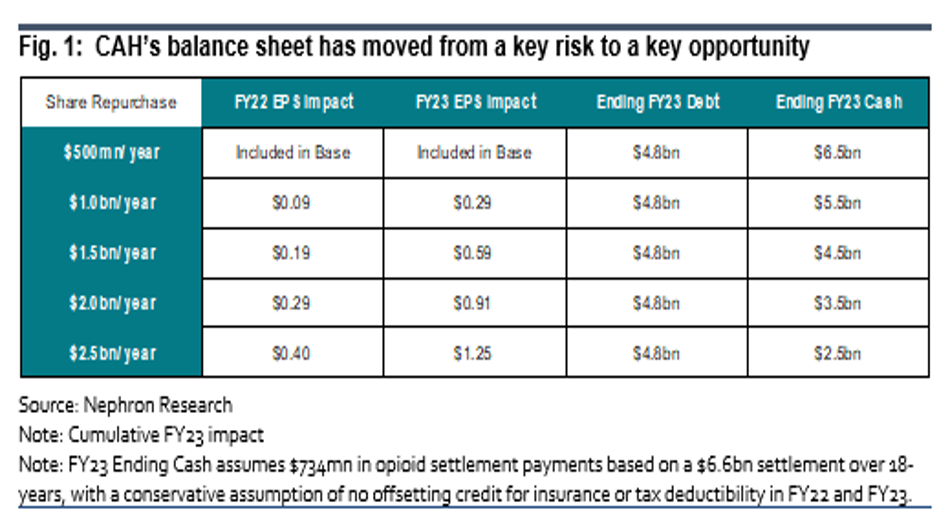

Last week, Nephron clients saw Eric Percher and team upgrade Cardinal Health shares to Buy from Hold and increase their 12-month target price to $74 (+23%)…but NOT for the reasons you might think. While opioid litigation reserves indicate a settlement is near, our upgrade was predicated as much on management’s recent commentary on post settlement capital deployment priorities and the Cordis divestiture – which served to clarify potential earnings power – as on post settlement multiple expansion. We project debt reduction, litigation expense reduction and share repurchase expansion could drive our base case FY23 EPS higher by ~12% to as much as ~22% over where our numbers are now. To learn more about this call and working with Nephron Research, email info@nephronresearch.com