Life Science Tools & Diagnostics – “2H21 Setup”

July 9, 2021

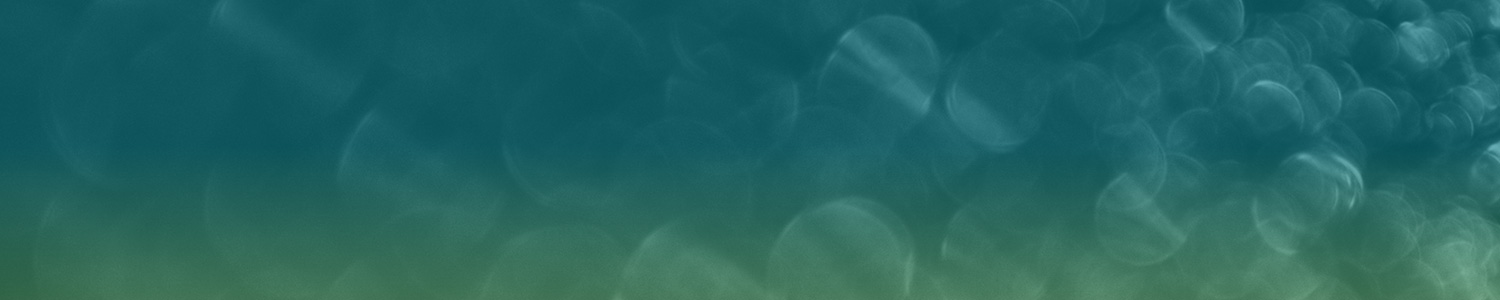

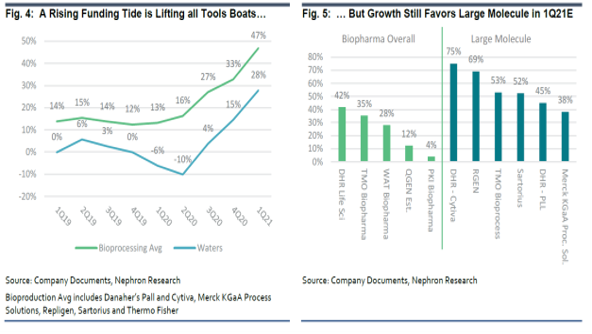

Earlier this week, Jack Meehan and team published a beefy 100+page 2H21 outlook to clients of their Life Science Tools & Diagnostics coverage. Jack called out the biopharma end market as an area of particular strength, where there is a lot to like entering 2H21 (and the long-term future looks bright too). The funding environment remains robust for new large molecule investment, and an accommodative FDA bodes well for even more new investment. At a high level, there are a number of factors which give Jack conviction in the strength of biopharma funding:

- Breakthroughs in science are allowing for completely new classes of drugs to succeed

- Good science, combined with an accommodative FDA, are driving new drug approvals to record levels, which should support future investment

- Capital markets activity is creating a robust funding environment, and

- Patent cliffs are driving investments by larger biopharma companies as they aim to refresh drug pipelines. While patent cliffs and an accommodative FDA can encourage investment from larger biopharma companies, strong access to funding through the capital markets has spurred R&D investments by SMiD biopharma companies. These companies are capitalizing on scientific advancements allowing for the treatment of new, more targeted indications, often with new mechanisms (i.e. cell or gene therapies).

In the broader report, Jack and team updated their views on covered stocks & performance, identified upcoming catalysts, and provided updates on the FDA action, volumes, and capital equipment fundamentals. For more information on the “2H21 Setup” and Nephron Research, please email info@nephronresearch.com