Nephron’s Jack Meehan Initiates Life Science Tools & Diagnostics Coverage

July 2, 2020

Earlier this week, Nephron Research’s Jack Meehan initiated coverage on the the Life Science Tools & Diagnostics sector. From Nephron’s July 1st press release:

With the addition of Meehan, Nephron adds a like-minded partner whose product is already essential and built to flourish on the firm’s independent platform. Jack’s methodology meshes perfectly with Nephron’s integrated approach to research and adds to Nephron’s industry thought leadership. In Jack’s own words:

“Clients should expect more proprietary research, more industry expert events, more unique data sources, and more actionable recommendations for their investment portfolios. Looking ahead, there are a number of compelling debates across my Life Science Tools and Diagnostics coverage, and we see real opportunity to create alpha.”

Jack brings to Nephron Research over a decade of deep experience in healthcare research having been named both a Rising Star and ranked in the top 5 of II’s All American Research poll. He most recently led Life Science Tools & Diagnostics efforts for Barclays.

With his arrival, Jack initiated research coverage on twenty three names across Life Science Tools, Diagnostics, National Labs and CROs/CDMOs. At a high level, Jack addressed the state of the broader sector:

As suppliers of innovation, we think the history of the group helps to provide visibility into the path forward. The diversified business models and relatively favorable end market conditions allowed the group to weather the COVID-19 storm better than the broader market. Following a major stock recovery since March 2020, we think the group has earned its multiple – and it will stick given uncertainty around the virus heading into the Fall. Our stock recommendations are driven by our proprietary end market trackers, survey work, unique datapoints and industry expert interviews.

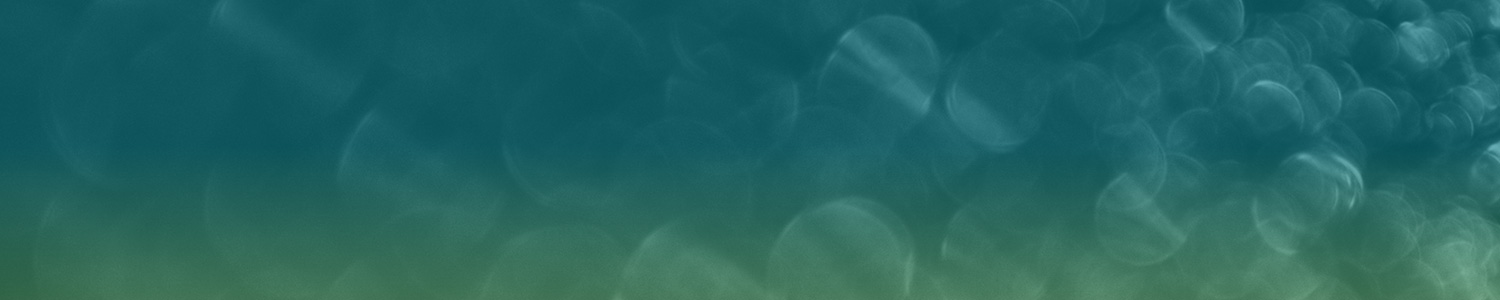

A a more granular level, Jack laid out his views in a 364 page initiation report and accompanying video call to clients covering broad market themes and individual company views. For example, Jack walked through his COVID-19 detection market model which he described as a “huge opportunity, but highly dependent on a volatile virus”. Specifically:

- Our base case is that the detection testing market could represent a $4bn opportunity for our Diagnostics coverage in 2020, and ramp up to $8bn in 2021. Our 2020 estimate of $4bn is almost as large as the overall MDx market, while our 2021 estimate of $8bn is modestly larger.

- We view the serology opportunity as more modest, at roughly $600mm in 2020. As described in more detail, we believe the relative size will be driven by the relative value proposition of testing and also the relative price point ($30 for detection, $5 for serology).

- We size the US lab opportunity for detection testing at $9bn in 2020E, and $17bn in 2021E. We size the serology opportunity at $2.2bn in 2020E, and $1.7bn in 2021E.

To learn more about subscribing to Nephron Research, email info@nephronresearch.com or visit www.nephronresearch.com