Telehealth Must Retool Post Pandemic: Initiating Coverage of TDOC and AMWL

February 23, 2021

“…it is our view that the most important market dynamic emanating from the pandemic is not the step-function increase in adoption, but the step-function change in providers perspectives on the current and future potential of telehealth: provider’s embrace of virtual care threatens to appropriate payor/employer telehealth territory. It is this trend and the inflows of capital into pure-play telehealth vendors which are at the heart of our analysis of the post-pandemic competitive environment.”

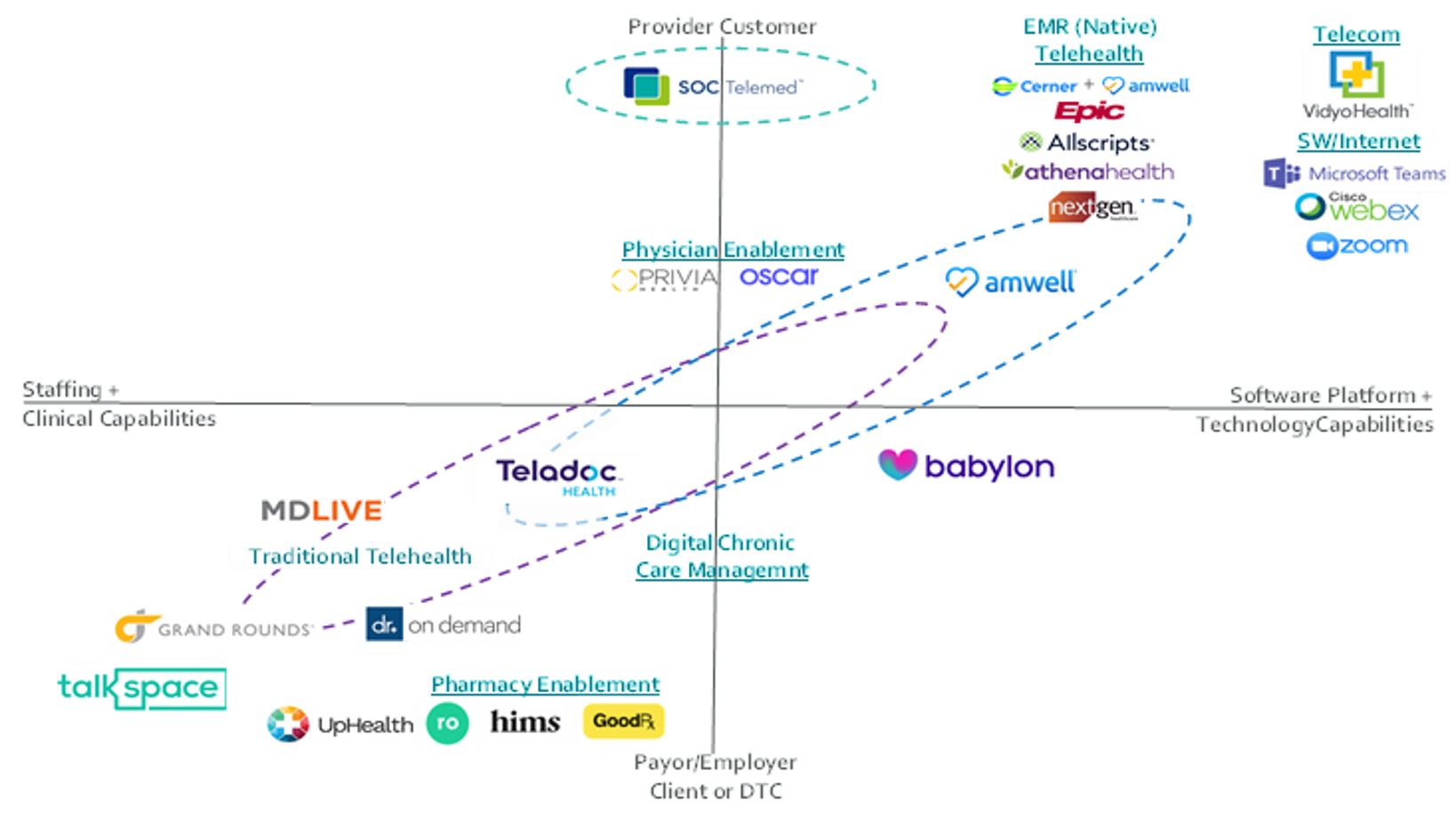

Last night, Eric Percher and team initiated coverage of the telehealth industry with a comprehensive examination of post-pandemic competitive dynamics. The focus of the ~60 page report extended well beyond public players Teladoc and Amwell on which he picked up formal stock coverage today. It also considered pure-play telehealth vendors who are likely to enter the public markets over the coming year as well as EMR vendors with native telehealth offerings, physician enablement companies with telehealth capabilities, and teleconferencing software providers.

More specifically, Percher dug into the following:

- Shifting Provider Competitive Dynamics. Increasing competition from health systems with sophisticated clinical resources that will encroach on payor/employer telehealth territory over time. He sees it as imperative for payor centric telehealth vendors to re-tool their models to align with payor’s broader virtual care offerings to ensure relevance.

- Increasing Telehealth Competitive Intensity. Percher’s competitive analysis includes Telehealth Pure-Plays: Teladoc, Amwell, Doctors On Demand, Grand Rounds, MDLive, SOC Telemed, Talkspace, and UpHealth; Teleconferencing Software Providers: Microsoft Teams, Cisco Webex and Zoom, and EMR Vendors: Epic, Cerner, Allscripts, athenahealth and NextGen.

For more information on the telehealth report and Nephron Research, email: info@nephronresearch.com