Toward an Endemic Covid-19 State

February 10, 2022

Last week, both Jack Meehan (Life Science Tools & Diagnostics) and Eric Percher (Pharma Supply Chain and Digital Health) allowed themselves to look forward to a more endemic approach to COVID-19 management and what that means for covered companies. They each published substantial notes to clients focused on that forward look.

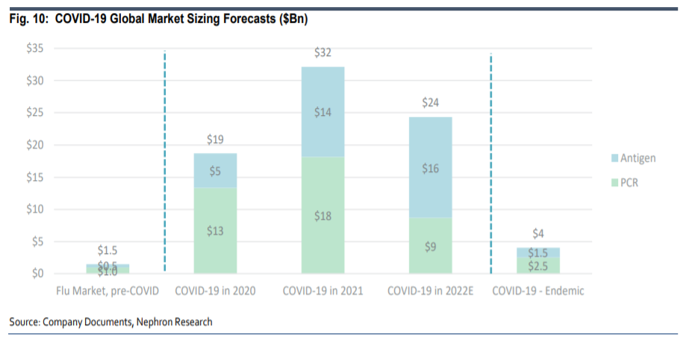

Jack provided subscribers with perspectives on what an endemic COVID-19 testing market could look like for his Dx coverage. Its worth noting that COVID-19 does not look endemic (yet). The US has now faced five waves of the virus. The question is what comes after Omicron? The good news is that a large portion of the population will have some level of natural immunity entering the Spring 2022, and we are learning to live with the disease. Jack’s note paid particular attention to sizing the “endemic” testing environment, the re-consolidation of automated PCR platforms and broader winners and losers within the LST&D group

Eric also believes we are in a transitional state, but with this transition in mind, he’s focused on the impact of COVID-19 vaccination and test volumes in 2022, with our proprietary Vaccine and Testing models supporting the outlook for a ~65% decline in pharmacy COVID-19 volume 2021 to 2022. While we have long used our COVID-19 Vaccine model to drive pharmacy and distributor projections, recent pharmacy commentary allows us to better pinpoint the impact from COVID-19 Testing to covered companies. CVS’s recent 2022 guidance made clear the rapid contraction of vaccine and testing expected over the course of 2022. WBA’s August year-end and the company’s sensitivity to COVID-19 contributions (which account for 14% of 2Q22 gross profit), set up an even more difficult comparison from FY22 to FY23. info@nephronresearch.com for more information.