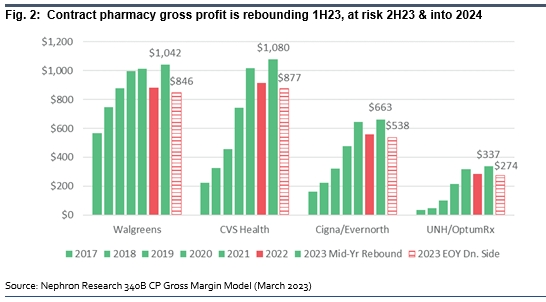

340B Pharmacy Tailwind/Manufacturer Headwind Poised to Reverse in 2H 2023

March 21, 2023

Since July 2020, a pitched battle has been playing out between manufacturers seeking to limit rapid expansion of 340B discounts via contract pharmacies and 340B eligible hospitals, health centers and clinics. A year ago, we forecasted an absolute decline in contract pharmacy discounts in 2022 which was born out as CVS and WBA disclosed significant headwinds in October. As we exited 2022, the trend reversed with 340B entities increasingly submitting claims data to regain access to discounts, driving a greater than appreciated late 2022 and early 2023 tailwind for contract pharmacies and 340B eligible entities at the expense of manufacturers. But the battle is not over. The first of three court rulings opened the door to more restrictive manufacturer policies in Feb. and Mar. If the remaining two rulings follow suit, we expect manufacturers will respond rapidly and aggressively, leading to a sharp reversal in contract pharmacy discounts/profits in 2H 2023.

In an expanded industry note to clients today, Nephron’s Drug Supply Chain and Health Policy teams weighed in on the impacts of recent trends in discount flow through contract pharmacies (CP), claims data submission, and recent manufacturer actions poised to turn the tide again in 2H23. Email info@nephronresearch.com for more on this report and others.