Behold, the Nephron Specialty Market Model 2018-2022

March 5, 2018

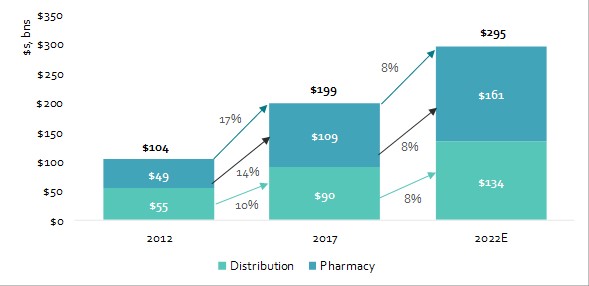

This week, Nephron Research published the inaugural Nephron Specialty Market Model, our bottom-up forecast for the specialty pharmaceutical market 2018-2022. The market model provides growth projections across 18 therapeutic categories with an eye toward the implications for Specialty Distribution and Specialty Pharmacy channels.

- After a period of elevated mid-teens growth 2013-16, the specialty market is projected to grow at an 8% CAGR 2017-2022E. The rate of growth is slowing, yet the absolute value of specialty product expansion 2017-2022 is on par with 2012-2017 at ~$95bn. Perhaps more important, whereas HCV weighed on margins 2012-2017, SDs have taken actions to stabilize margin 2018-2022, SPs will benefit from limited distribution product introductions and biosimilars could create opportunities for margin expansion over time.

- We estimate cumulative gross profit derived from specialty fulfillment and manufacturer services by the 7 largest supply chain participants totaled $8.5bnbn in 2017, or 4% of net expenditures. Among wholesalers, ABC has the greatest exposure to specialty, which accounts for 31% of gross profit, as compared to 9% at MCK and 7% at CAH. Among PBMs and pharmacies, ESRX has the greatest exposure to specialty at 20% of gross profit, as compared to 11% at OptumRx, 6% at CVS and 3% at WBA.

The full report includes Nephron’s analysis of Distributor, PBM and Pharmacy specialty gross profit pools (i.e.: where do we find the greatest opportunity among supply chain participants?) and examines total supply chain gross profit as a percentage of net sales (i.e.: how much of the delta between specialty manufacturer gross and net revenue is attributable to the supply chain?).

For more info on Nephron Research and the Nephron Specialty Market Model 2018-2022, email us at info@nephronresearch.com