Decade-Long 340B Tailwind Gives Way to Significant Pharmacy Headwind in 1Q 2022

April 11, 2022

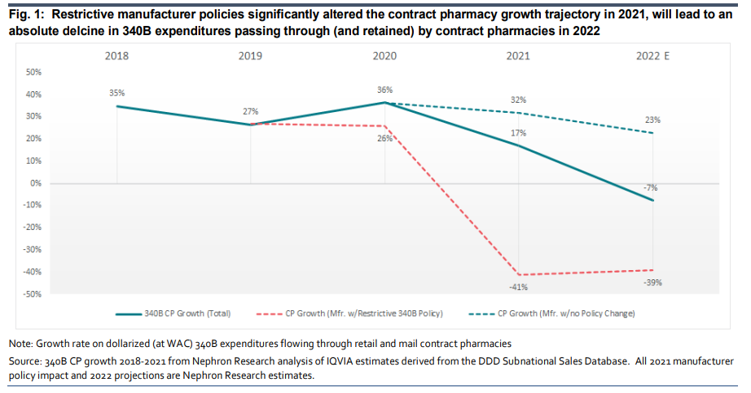

Eric Percher, Josh Raskin, Paul Heldman, and teams out with a beefy analysis of recently released 340B program sales data for 2021. What’s abundantly clear is that manufacturer 340B contract pharmacy policies introduced in late 2020 dramatically reduced program growth in 2021. The team projects that incremental policy introductions in late 2021 and early 2022 will drive an absolute decline in contract pharmacy profit for the first time in a decade in 2022 (down -7% in 2022 vs a +34% CAGR 2017 to 2021). Consequently, 340B contract pharmacy operations will shift from a material tailwind 2017-2021 to a material headwind in 2022 for Walgreens, CVS Health and to a much lesser extent Cigna/ESI and UNH/OptumRx while acting as a 2022 tailwind for manufacturers AbbVie, BI, and GSK, followed by Amgen, Bristol, Gilead, JNJ, Pfizer and Merck.

- Pharmacy headwind is most signficant for WBA. Our analysis points to the loss of a massive pharmacy tailwind at WBA where potential earnings impact is greatest given a relative lack of diversity as compared to CVS Health and even more limited exposure at Cigna/ESI and UNH/OptumRx.

- Manufacturer benefit varies with 340B policy, therapy discount level and channel. For 2022, we observe: 1) Lilly guided for a 1-2% negative impact from changes to the 340B policy to provide discounts in return for data submission, but given limited Covered Entity uptake this appears conservative, 2) we have yet to hear any guidance from mfrs. taking action in 2022 – Amgen, JNJ AbbVie Bristol, Pfizer, GSK and Gilead -suggesting net price upside to guidance.

- Derivative impact extends beyond pharmacy and pharma to Hospital (covered entity), Wholesaler and Payor. Beyond pharmacy and pharma, we will also examine second and third derivative impact for hospital covered entities (loss of CP profit, expansion of internal 340B efforts), wholesalers (primarily working capital), Part D Plans (potential increase in network rates), PBMs (potential loss of TPA and specialty pharmacy profit) and Payors/Employers (potential exposure to reductions in pharmacy network rate subsidization and duplicate discounts.

For more on this analysis and working with Nephron Research, please email info@nephronresearch.com