CVS Acquisition of Signify Health – Implications for the Broader Physician Enablement Sector

September 6, 2022

Yesterday, Nephron’s Eric Percher and Josh Raskin teamed up to provide Nephron subscribers with detailed thoughts on CVS’ emergence as the winner in a competitive process for Signify Health following their formal acquisition announcement for $8bn. If nothing else, the purchase price is indicative of the strong strategic interest in the sector.

The announcement puts to rest a strategic review at Signify that was reported to have elicited bids from CVS, Amazon, and potentially others, and has now culminated in a transaction at 31x forward consensus EBITDA, a 78% premium to where SGFY traded prior to announcing the strategic review in early August. Signify represents a significant step forward for CVS’s healthcare services ambitions in home health and provider enablement. While the cost is high, the impact to leverage ratios is limited and we estimate the transaction could drive 1.5% accretion in 2024, supporting CVS’s L-T EPS expansion goal.

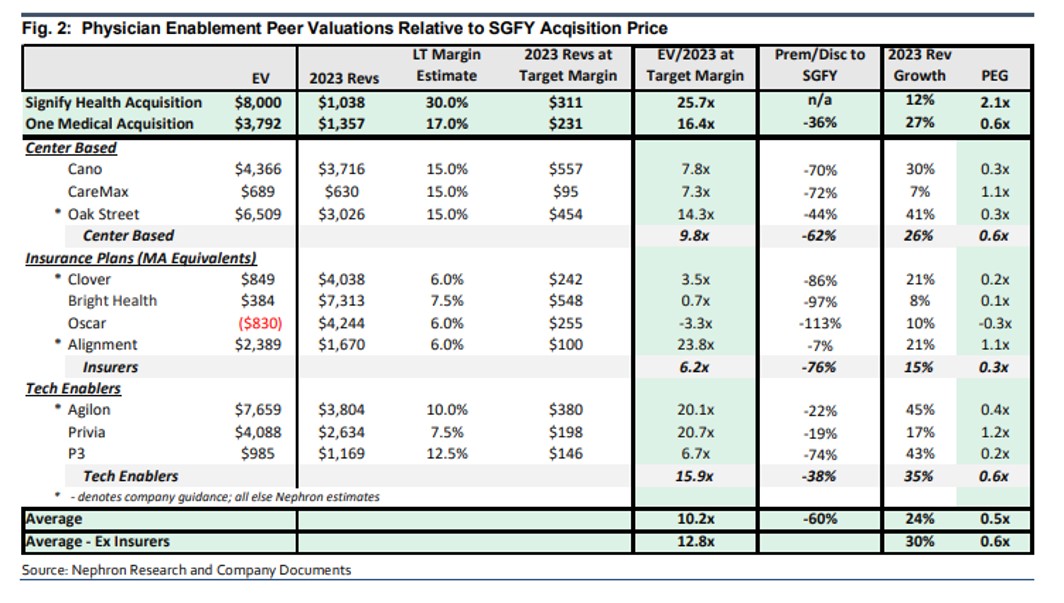

Within the context of the team’s broader “Physician Enablement” thesis, we believe this transaction serves as an important data point. The team were quick to point out that both the One Medical (2.8x 2023 revenues) and Signify (7.7x 2023 revenues) acquisition multiples suggest that the peers are all trading at significant discounts to the strategic valuations. Equally important, the team doesn’t think Signify precludes CVS from another, even potentially large, transaction in the future. While Signify helps CVS toward its goals of provider enablement and home based care, the company still seems focused on acquiring primary care capabilities.

For more information on the report and on Nephron Research please email info@nephronresearch.com